China's electric vehicle (EV) market is experiencing unprecedented growth, driving significant job creation worldwide.

Notably, homegrown maker BYD has expanded its workforce dramatically, adding nearly 500,000 employees since 2019.

Currently, BYD's workforce, numbering over 700,000, is nearly double that of Japanese giant Toyota’s 375,000 employees.

BYD's seemingly rapid ascension reflects a broader trend in China’s auto industry.

By the end of 2023, the number of employees in China’s private sector had surpassed 30 million, marking a 13 per cent increase over a four-year span which saw the brand undertake a massive bid for global dominance.

China on the rise

According to the International Energy Agency's (IEA) Global Electric Vehicle Outlook 2024, China effectively cornered the global EV and plug-in hybrid electric vehicle (PHEV) market, accounting for 60 per cent of worldwide sales last year.

New energy vehicle (NEV, a Chinese term for clean cars) registrations in China reached 8.1 million in 2023, a 35 per cent year-over-year increase.

Additionally, China bested Japan and emerged as the largest auto exporter globally in 2023, exporting over 4 million vehicles, of which 1.2 million were NEVs—a staggering 80 per cent year-over-year increase.

Projections indicate that by 2030, one in three cars in China will be electric.

Eerily, a similar projection indicates that by decade's end, a whopping third of all new cars sold globally will have Chinese origins.

Aggressive pricing fuels growth

One key factor driving the surge in EV adoption in China is overwhelming price parity, even swaying the other side to the disadvantage of conventional vehicles.

The IEA reports that around 55 per cent of EVs sold in China in 2022 were cheaper than their internal combustion engine (ICE) counterparts.

This figure rose to approximately 65 per cent last year, with major EV manufacturers like BYD launching more affordable models.

BYD's unique value proposition of providing quality craftsmanship and leading technology at attainable prices has resonated with a market desperate for cheaper EVs.

In New Zealand, vehicles like the Atto 3 SUV, Dolphin hatch and Seal sedan have garnered not just customer attention but crucial sales.

BYD’s continued expansion

Despite concerns about a potential slowdown in the EV market (in turn igniting hybrid fever), BYD continues to break sales records.

As of April this year, BYD has sold over 434,500 EVs globally, riding on the success of budget EVs like the Dolphin Mini.

But the company is not just focusing on affordable models. It is wisely diversifying its lineup and turning into uncharted segments with NZ-bound models like the Shark PHEV ute and Sealion 6 PHEV SUV.

Additionally, insiders say BYD is readying a new Seal model, with a reveal potentially set for next month. BYD apparently wants this vehicle to compete directly with Tesla’s recently updated Model 3.

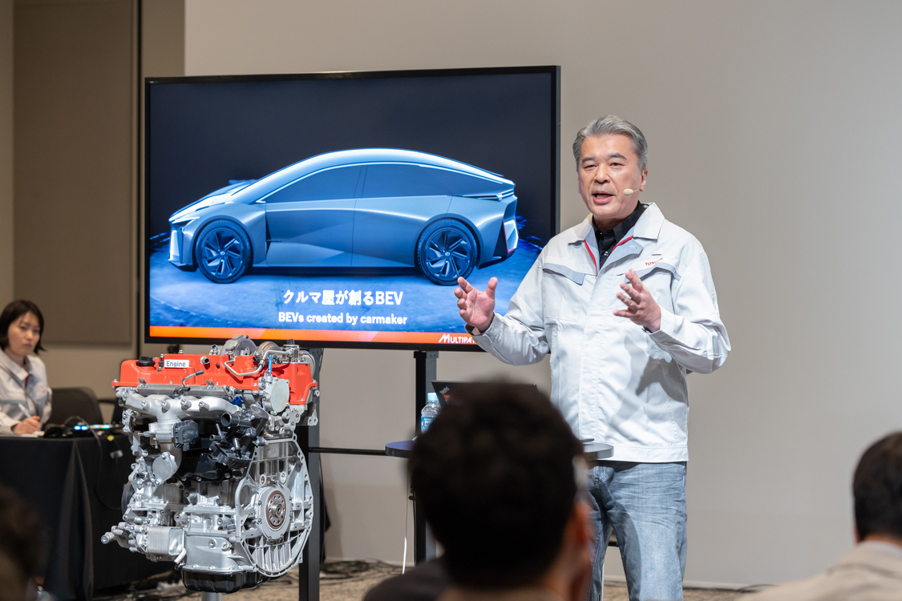

Toyota’s divergent strategy

In contrast, Toyota is developing new internal combustion engines in collaboration with Subaru and Mazda, diverging from the industry-wide shift towards electrification.

This strategic move places Toyota in a precarious position as the global market increasingly favours hybrids and EVs. It has so far only released one mainstream EV, the bZ4X SUV, which we've covered extensively.

There's a bright spot for Toyota, however, as these new engines are expected to integrate EV components for enhanced performance and efficiency.

Toyota also possesses a strong hybrid vehicle portfolio, so it wouldn't be out of the question to see the Japanese maker deliver stronger hybrid systems down the line.

As the EV market continues to evolve, it will be intriguing to observe how workforce dynamics develop between BYD and Toyota.

BYD's aggressive expansion and strategic pricing have positioned it as a formidable player in the global EV market. Meanwhile, Toyota's commitment to traditional engines could impact its competitiveness in the coming decade.

Only time will determine which strategy proves successful and sustainable.