There’s a saying that goes: “If it appreciates, buy it. If it depreciates, lease it.”

So if it’s a house, for example, it’s better to buy than rent, if viable, because you’ll make capital gains that justify that outlay. And theoretically if it’s a car, which will likely lose 50-60 per cent of its value in the first few years of its life, you should lease it, right?

Not necessarily. In fact, most private motorists still buy their cars in New Zealand, although leasing is common for businesses – especially those running fleets. Even some rental car companies lease their cars.

Read More: Car Choices Part 1, should you buy new, used... or 'nused'?

Last time we covered new, used or ‘nused’, so this time we look at financing options, largely down to buying or leasing.

What’s the difference between the two?

“Owning” a car means you’ve paid up front for it. Even if you’ve borrowed money to buy the car and are paying it off, you still own it: because the dealership gets its money and transfers ownership to you straight away. When the finance payments are finished, the vehicle is yours to keep.

“Leasing” basically means somebody else (usually a lease company) owns the car and you’re paying for the use of it. It’s similar to renting then, but the terms of the agreement are fixed and for a predetermined term, typically three to five years.

BUYING: pros & cons

The pluses of owning:

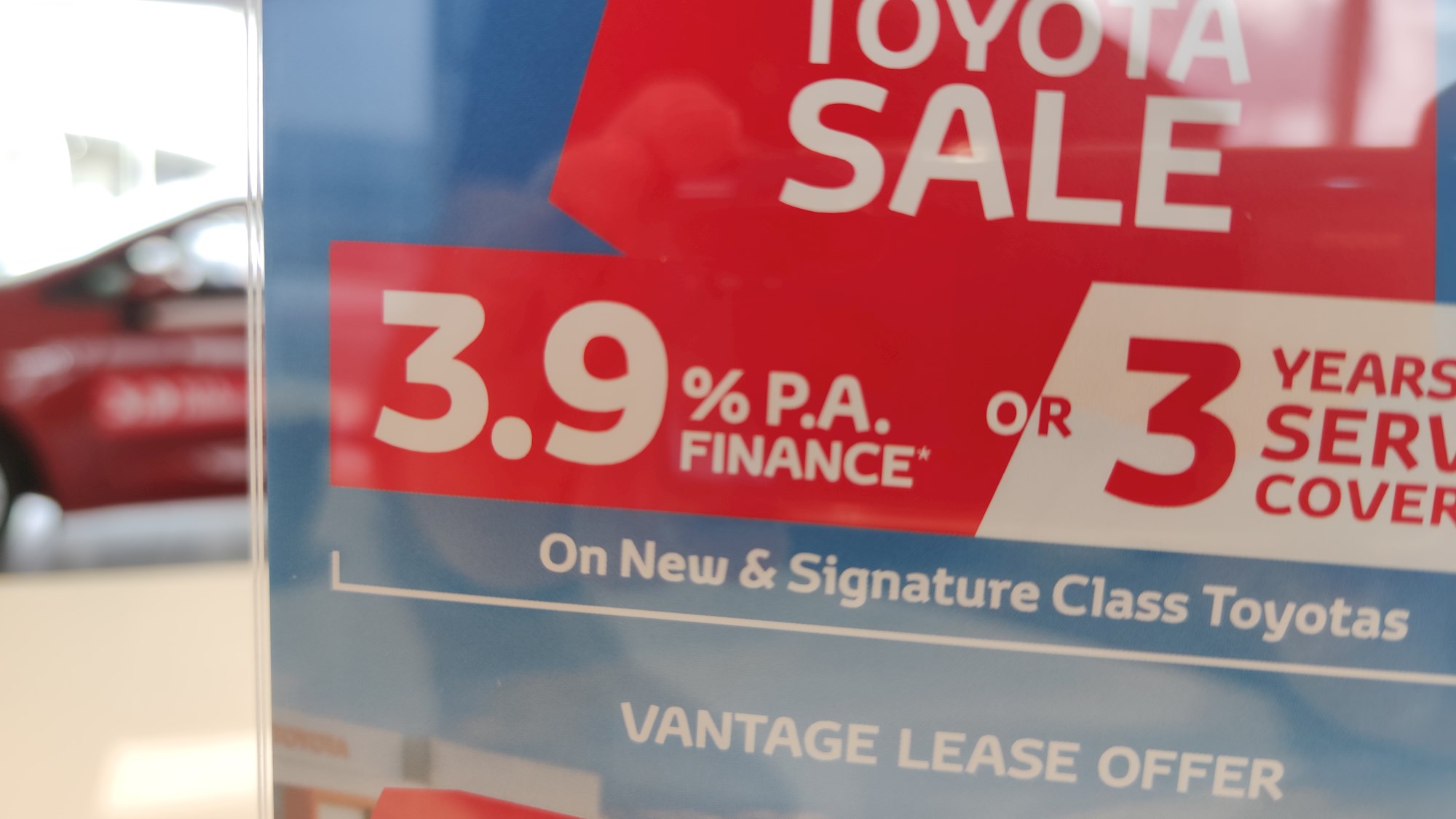

- Lots of attractive finance deals at the moment

- No restrictions on what you can do with your car

- You own a practical, valued asset to keep/sell

The minuses of owning:

- You might have to pay a big deposit

- You can end up with negative equity

- Dealing with the uncertainty of depreciation and trade-ins

If you can afford to pay for a car up front or are getting a super-sharp finance deal (little or no deposit with little or no interest is not uncommon for new cars at the moment), it makes sense to buy because it’s costing very little extra over the list price.

On the topic of dealer versus personal finance, both offer attractive interest rates, but be sure to check the added costs, such as an establishment fee, monthly account management fee and in particular, early repayment penalties for paying off the loan early (and saving interest).

Even if you’re getting finance, having ownership of a car still appeals to most private buyers. You can do what you want with the car, there’s motivation in knowing you’re paying off an asset that you will eventually own and there aren’t a whole lot of terms and conditions to adhere to.

Downsides? You might have to pay a chunk of money up front as a deposit, if you’re buying new you’re having to ride that initial wave of depreciation and you are 100 per cent responsible for servicing and maintenance (although new-vehicle warranties and service plans can help address that).

If you’re the kind of person who wants the latest model and likes to update every few years, you might also find yourself in negative equity for long periods – owing more on finance than the value of your asset – which doesn’t make a lot of sense.

LEASING: pros & cons

The pluses of leasing:

- Tax advantages for businesses (depending on lease type)

- Certainty of overall cost for lease term – no surprises

- You could drive a better car than you can afford to “buy”

The minuses of leasing:

- You’re left with nothing at the end (unless you buy the car after all)

- Potential limitations on mileage and use

- Renting never feels as nice as owning for the car-minded

There are two main types of leases: finance and operating. And to some extent, a third called “novated”, where a company pays the lease on behalf on an employee from their pre-tax salary.

A finance lease is a bit like hire purchase: you pay a monthly amount, which can go towards eventually purchasing the vehicle via a predetermined “balloon” payment at the end. If you don’t want to buy it, you simply give the car back – on the assumption that the final payment is equivalent to the value of the car at that time, which is something lease companies are very good at calculating.

An operating lease is tailored for businesses and is much more like a rental agreement: there’s a monthly fee and often everything is taken care of, including insurance and servicing. At the end of the term, the vehicle must be returned.

Operating leases also allow companies to claim the entire cost of the lease against tax, which you can’t do with a finance lease (although you can claim the GST on your monthly payments).

The great thing about leasing is certainty: you know exactly what it’s costing you every month to have a particular car over your period as lessee.

Because it’s a fixed financial quantity, it’s possible that a lease arrangement will get you into a more expensive car than you could afford if you were purchasing - you can decide your budget and go for it. Because lease companies are very good at calculating residuals, if you choose a car that has good retained value (Toyota Corolla or Ford Ranger, for eg), that’s often reflected in a lower monthly payment.

There are also no hassles when it comes to sale or trade-in time, because once the lease is done it’s not your problem: the lease company is responsible for disposal of the vehicle and you can simply move on to the next one.

For businesses, all of the above wrapped up in the potential Fringe Benefit Tax (FBT) exemptions of something like a signwritten ute can make leasing part of a very attractive company-vehicle package.

The cons? Well, if you just lease and walk away, you’ve paid the cost of ownership but are left with a big nothing in the driveway.

Most lease agreements also have limitations on annual mileage and wear-and-tear, which means you have to be pretty sure how much you’re going to use it before you start. If you go over your allocated kilometres or the car incurs more damage than is considered reasonable by the lease company, there will be penalties and refurbishment costs.

As a private buyer, sorry lessee, that does take a bit of the freedom out of having your own car.